How is lead priced?

The global lead resources are mainly distributed in Australia, China, Russia, the United States, Peru, and Mexico. China ranks second in lead resource reserves and is the largest producer and consumer of refined lead, with a certain pricing power at the consumer end.

Futures market pricing is currently the main pricing mechanism for global lead resources. The London Metal Exchange (LME) is the international pricing center for lead, while the Shanghai Futures Exchange (SHFE) is the regional pricing center for Asia. The influence of Shanghai lead futures prices is increasing. Since the establishment of LME in 1876, futures prices have become a barometer of the international non-ferrous metal market. In 1920, lead was listed and traded on LME. In 2017, the trading volume of LME lead was 170 times that of the world trade volume that year. In 2021, the trading volume of lead options was 320000, an increase of 31% year-on-year. The prices and inventory announced by LME have a significant impact on global lead production and trade. Since the listing of SHFE lead futures in 2011, the international lead market has gained a Chinese voice, improving the phenomenon of domestic enterprises passively accepting prices. SHFE lead futures have become an important component of the international pricing system.

Affected by global consumption and supply-demand relations, lead prices have experienced five broad fluctuations since 1970.

One is the cycle of rising and falling lead prices from 1970 to 1985, with an upward trend in lead prices from 1970 to 1979. The rapid economic development of Western countries stimulated lead consumption, and lead prices briefly declined during the 1974 energy crisis before rebounding. Subsequently, in 1979, the price of lead plummeted significantly from $1054.75 per ton to $380.14 per ton in 1985. The second is the 1986 1993 oscillation cycle, where lead prices rebounded to $776.34/ton in 1990 and fell to a trough of $418.28/ton again in 1993. The third period was the rise and fall period from 1994 to 2002, with lead prices rising back to $772 per ton in 1996 and then experiencing a 6-year decline period. The fourth is the rapid upward period from 2002 to 2007. Since 2002, the global demand for refined lead has continued to grow, and the market supply and demand relationship has led to a rapid increase in lead prices. Especially after China began imposing a 10% export tariff on refined lead in July 2007, lead prices have skyrocketed to $2567.98 per ton. The fifth period is from 2008 to present, with lead prices fluctuating with supply and demand. As of December 2022, the average closing price of LME lead futures (electronic trading) was 2198.32 US dollars per ton.

The global lead ore resources are abundant, mainly distributed in Australia and China, with large lead mines mainly concentrated in Australia and Canada.

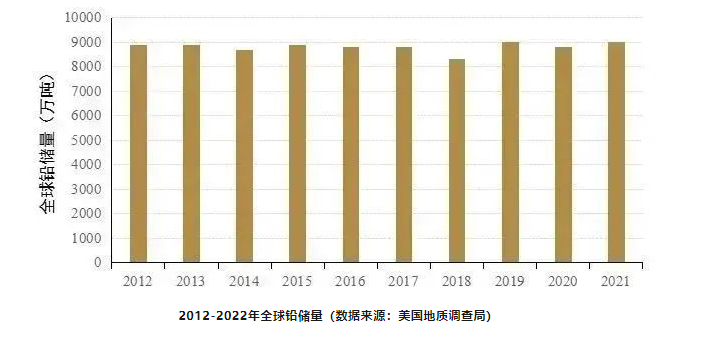

Firstly, global lead ore resources are abundant, mainly distributed in Australia and China, accounting for over 60% of the total. Next are Peru, Mexico, the United States, Russia, and others. In the past decade (2012-2022), global lead reserves have remained stable without significant changes. At the end of 2021, the United States Geological Survey announced a global lead reserve of 90 million tons.

Secondly, large lead mines abroad are mainly concentrated in countries such as Australia and Canada, while China has explored large and medium-sized ore deposits mainly distributed in the five major metallogenic regions. The total lead and zinc reserves in the Brokenshire mineralization concentration area, MacArthur River lead and zinc mine, and the Mont Aisa inner enclosure area in Australia are over 92.49 million tons; The lead and zinc reserves in the Selwin Basin of Canada are 900 million tons, with a total of over 30.35 million tons of lead and zinc reserves in the Sullivan and Kidcreek deposits; In addition, Alaska and Ireland in the United States also have some large lead mines, and there are also large polymetallic deposits in central Peru in South America and Kazakhstan in Central Asia. These lead mines are characterized by high grade, large reserves, or a long history, providing huge resource support for global lead. The ultra large and medium sized mineral deposits that have been explored in China are mainly distributed in the five major metallogenic regions of western Yunnan, Sichuan Yunnan, Qinling Qilian Mountains, Langshan Mountain in Inner Mongolia, and Great Xing'an Mountains.

Global lead production has steadily declined, with China, Australia, the United States, Peru, and Mexico as the main producing countries, with limited pricing advantages at the production end.

Firstly, global lead ore production has first increased and then decreased, with a steady but slight decline in the past decade. It is expected that the growth rate will be about 2% in 2022. The changes in global lead ore production can be roughly divided into two stages. Before 2013, the overall trend was on the rise, with lead production reaching a high of 5.49 million tons in 2013; After 2013, lead production remained stable and slightly decreased, but remained in a declining state in 2021, with global lead ore production reaching 4.3 million tons.

From 2016 to 2018, global lead production in mines entered a downward cycle due to the closure of large overseas lead and zinc mines; In 2019, with the increasing shortage of raw materials, lead prices rebounded, stimulating the resumption of global production projects and the production of new mining projects, leading to an increase in global lead concentrate production; In 2020, affected by the COVID-19, the relevant restrictive measures have seriously affected the mining industry in Argentina, Mexico, South Africa and many other countries, and the lead ore output has decreased by about 5% compared with 2019; With the continuous control of the epidemic and the promotion of market demand, lead production will gradually recover. It is expected that the global lead ore production growth rate will be around 2% in 2022.

The second is that China, Australia, the United States, Peru, and Mexico are the main lead producing countries, with the total production of the five countries accounting for 78%. Among them, China accounts for 46.5%, Australia accounts for 11.6%, the United States accounts for 7%, Peru accounts for 6.5%, and Mexico accounts for 6.3%. The total production of the five countries accounts for 78%.

From 1994 to 2013, China's lead ore production showed a rapid upward trend, surpassing Australia as the largest lead producing country in 2004. In 2013, China's lead ore production reached 2.9 million tons, accounting for 53% of the global market; After 2013, China's lead ore production has slightly decreased, but it is still much higher than other countries.

Thirdly, the global annual production of lead metal remains stable, at approximately 11 million tons, with production halving in 2021. According to data from the International Lead and Zinc Research Group, from 2011 to 2020, the average global lead metal production was 11 million tons per year. In 2021, the lead metal production was 5.85 million tons, mainly affected by the repeated epidemic and mine closures.

The global demand for lead resources is fluctuating, and China, as the world's largest consumer and importer of refined lead, has a certain pricing advantage on the demand side.

Firstly, global lead demand is fluctuating, with China being the world's largest consumer of refined lead. The global lead demand has shown an overall upward trend in the past decade, mainly driven by the growth of refined lead consumption demand in China. From the perspective of consumer countries, China is the largest consumer country, accounting for about 43%, which is basically on par with the proportion of production, followed by the United States, India, and South Korea, accounting for 13%, 5%, and 2% respectively.

Secondly, over 80% of lead consumption is used for lead-acid batteries, and China is the largest exporter of lead-acid batteries. The primary consumption of lead includes batteries, lead materials, lead oxide, etc. Lead acid batteries are the largest consumption area, accounting for 87% of the consumption; Next are lead materials and lead alloys, accounting for approximately 7%. Since 2004, lead-acid batteries have ushered in a development boom with the rapid development of industries such as automobiles and telecommunications in China.

Thirdly, the global supply of refined lead is showing a "surplus" trend. Due to the slowdown in geopolitical and economic growth, as well as the trend of declining lithium battery substitution, global demand for refined lead is showing a "surplus" trend. According to data released by the International Lead and Zinc Research Group (ILZSG), from January to August 2022, the global lead market experienced a supply shortage of 25000 tons, and an oversupply of 92000 tons during the same period in 2021; In 2021, the global lead market had an oversupply of 44000 tons, while in 2020, there was an oversupply of 183000 tons.

Global lead prices are influenced by the lead industry chain.

One is that the lead concentrate lead oxide lead-acid battery industry chain shows price linkage changes, and the demand for downstream products lead-acid batteries has a negative impact on upstream lead concentrate prices. In terms of the structure of the lead industry chain, the price linkage between lead concentrate, lead oxide, reduced lead, and lead alloy is strong, and the price changes remain basically in the same direction.

The second is that the supply and demand relationship determines the price of lead resources, which is influenced by the consumption of lead, especially lead-acid batteries, and shows seasonal changes. Usually, the second quarter is the off-season for consumption, the third quarter is the peak season for power batteries, and the fourth quarter is the peak season for sales of start stop lead-acid batteries.

Thirdly, the supply elasticity of recycled lead production capacity is relatively large, and the recycling price of waste lead batteries directly affects the market pattern of recycled lead. Lead itself has strong regenerative properties, therefore, regenerative lead plays an important role in the entire lead smelting industry. Lead can be fully recovered without any loss of physical and chemical properties, and currently 90% of the lead that can enter the circulating chain is recovered. The average consumption of recycled lead in developed countries accounts for over 60%. 63% of the scrap raw materials for lead-acid batteries are renewable and have low management costs, making the potential for the recycled lead industry enormous. The recycling of waste lead batteries stimulates the rapid development of the recycled lead industry, and the recycling price of waste battery recycling market directly affects the market pattern of the recycled lead industry.

The influence of Shanghai lead prices has gradually increased, becoming an important reference for the international pricing system and a reference price for Asian lead resource trading. The launch of Shanghai lead futures has effectively changed the purchase and sales model that relies entirely on orders, fully reflecting the reasonable prices of international and domestic demand and interests of all parties. In 2021, the transaction amount of SHFE lead futures was 193977331300 yuan, with a trading volume of 25269752 million hands. Shanghai lead futures have become an important reference for the international pricing system.

China has abundant reserves of lead resources, but there are few rich ores with low grade, which makes mining difficult. The cost advantage of imported ores is obvious, and the production of metal lead is increasing year by year.

Firstly, China's lead ore reserves rank second in the world, second only to Australia. According to data from the National Bureau of Statistics, since 2002, China's lead ore reserves have shown an overall growth trend, especially with rapid growth after 2011. In 2016, China's lead ore reserves were 18.086 million tons; The confirmed resource reserves of lead ore and metal are also showing an upward trend, with a growth rate of 10% in 2016 and a confirmed resource volume of 98.329 million tons in 2019.

Secondly, China's lead mines are widely distributed with low average quality, and their reserves are mainly concentrated in the central and western regions, accounting for over 70% of the country's lead reserves. At present, lead resources have been discovered and explored in 27 provinces, regions, and cities in China, but their relatively abundant and current reserves are mainly concentrated in six provinces: Yunnan (26.6291 million tons), Inner Mongolia (16.0987 million tons), Gansu (11.2249 million tons), Guangdong (10.7732 million tons), Hunan (8.8859 million tons), and Guangxi (8.788 million tons). The total lead and zinc reserves are 82.3998 million tons, accounting for 64% of the national lead and zinc reserves, and the lead reserves account for 73.8%.

Third, China's lead ore imports continued to increase, with Russia, the United States, Türkiye, Peru and Australia as the main importing countries, accounting for more than 66%. China is rich in lead mineral resources and has a large annual output. But on the one hand, due to the rapid development of smelting capacity, the demand gap for minerals is becoming increasingly large; On the other hand, the cost advantage of imported ore is obvious. China imports a large amount of lead ore sand and concentrate from abroad every year. From the perspective of import and export quantity, in 2021, the import quantity of lead ore and its concentrate in China was 1.2 million tons, while the export quantity was only 1700 tons; From the perspective of import and export value, in 2021, the import value of lead ore and its concentrate in China was 1859.0778 million US dollars, and the export value was 570900 US dollars; From the perspective of import sources, Russia, the United States and Türkiye will be the main import countries of lead ore sand and lead concentrate in China in 2021, accounting for nearly 50%. In 2021, the repeated global epidemic and the soaring sea freight prices have to some extent disrupted the production and transportation of new lead ore production capacity, and China's lead ore import volume has significantly decreased.

Firstly, China's renewable lead production capacity is lower than that of developed countries, and it is still in a production capacity release cycle, with significant room for improvement. The consumption of recycled lead in China accounts for about 40%, far lower than 90% in the United States, 85% in Japan, and 60% in European countries. In recent years, the battery industry has developed rapidly, and the increase in lead demand has driven an increase in the production of recycled lead. In 2021, China's recycled lead production reached 3.6 million tons, a year-on-year increase of 17.6%, accounting for approximately 55.4% of lead production. The market size of the recycled lead industry reached 55.605 billion yuan. In 2022, the production of recycled lead will reach 3 million tons, accounting for 49.42%.

Secondly, China has taken multiple measures to enhance the concentration of the recycled lead industry, and the industry is developing towards standardization and park oriented development. Since 2010, China's recycled lead industry has been in the process of standardization, and the "Regulatory Conditions for the Recycled Lead Industry" has been introduced, gradually raising the industry entry threshold and further increasing the industry concentration. At present, China has formed seven major production areas: Jiangsu Province, Anhui Province, Henan Province, Jiangxi Province, Hebei Province, Shandong Province, and Hubei Province, and the renewable lead industry has developed towards park oriented development. A closed cycle production model of renewable lead has been formed in parks or industrial clusters, continuously promoting the development of renewable lead.

This article was originally published in the first edition of China Mining Daily on March 23